hotel tax calculator texas

The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms. The City of Austins Hotel Occupancy Tax rate is 11 percent comprised of a 9 percent occupancy tax and an additional 2 percent venue project tax.

Taxes Celina Tx Life Connected

Ad Finding hotel tax by state then manually filing is time consuming.

. That means that your net pay will be 45925 per year or 3827 per month. Local hotel taxes however are due only on those rooms ordinarily used for. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code.

If you make 55000 a year living in the region of Texas USA you will be taxed 9076. NA tax not levied on accommodations. The state hotel occupancy tax rate is 6 percent 06 of the cost of a room.

Notable examples include its hotel occupancy tax which is 6 of the cost of a hotel. Sales Tax Calculation Formulas. Your average tax rate is.

Add tax to list price to get total price. The state hotel occupancy tax rate is 6. A state employee is entitled to be reimbursed for hotel occupancy taxes incurred while traveling on state business.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. 1 State lodging tax rate raised to 50 in mountain lakes area. Texas Sales Tax Calculator.

Both taxes are collected by a third-party. Determining the amount you pay in hotel occupancy tax is simple for locations with state HOT tax only with few exceptions a room costing at least 15 per night is subject to a 6 percent state. HOTEL OCCUPANCY TAX RATES.

Texas law requires that each bill or other. To pay taxes please log into your account or contact Hotel Help 512974-2590 or email at hotelsaustintexasgov. The 6 percent state hotel tax applies to any room or space in a hotel including meeting and banquet rooms.

Property management companies online travel companies and other third-party rental companies may also be responsible for collecting the tax. Cities and certain counties and special purpose districts are authorized to impose an additional local. Sales tax list price sales tax rate.

The calculator will show you the total sales tax amount. Sales tax rate sales tax percent 100. A state employee is not exempt from paying a state.

Total price including tax. Call a hotel tax specialist toll-free at 800-252-1385. Determining the amount you pay in hotel occupancy tax is simple.

Just enter the five-digit zip code of the. The calculator will show you the total sales tax amount. The State of Texas imposes an additional Hotel Occupancy Tax.

The City collects a 7 Hotel Occupancy Tax and the Amarillo-Potter Events Venue District collects a 2 Hotel Occupancy Tax. Avalara automates lodging sales and use tax compliance for your hospitality business. No additional local tax on accommodations.

Texas also charges a number of additional fees and taxes on the sales of certain goods. Our online application process is simple. And if you live in a state with an income tax but you work in Texas.

Texas is a good place to be self-employed or own a business because the tax withholding wont as much of a headache. This tool is provided to estimate past present or future taxes. Avalara automates lodging sales and use tax compliance for your hospitality business.

Ad Finding hotel tax by state then manually filing is time consuming. The City of San Antonios Hotel Occupancy Tax rate is 9 percent comprised of a 7 percent general occupancy tax and an additional 2 percent for the. 70 455 7455.

Texas Income Tax Calculator Smartasset

West Virginia Tax Rates Rankings Wv State Taxes Tax Foundation

How Real Estate Investors Boost First Year Depreciation U S In 2022 Real Estate Investor Tax Reduction Tax Preparation

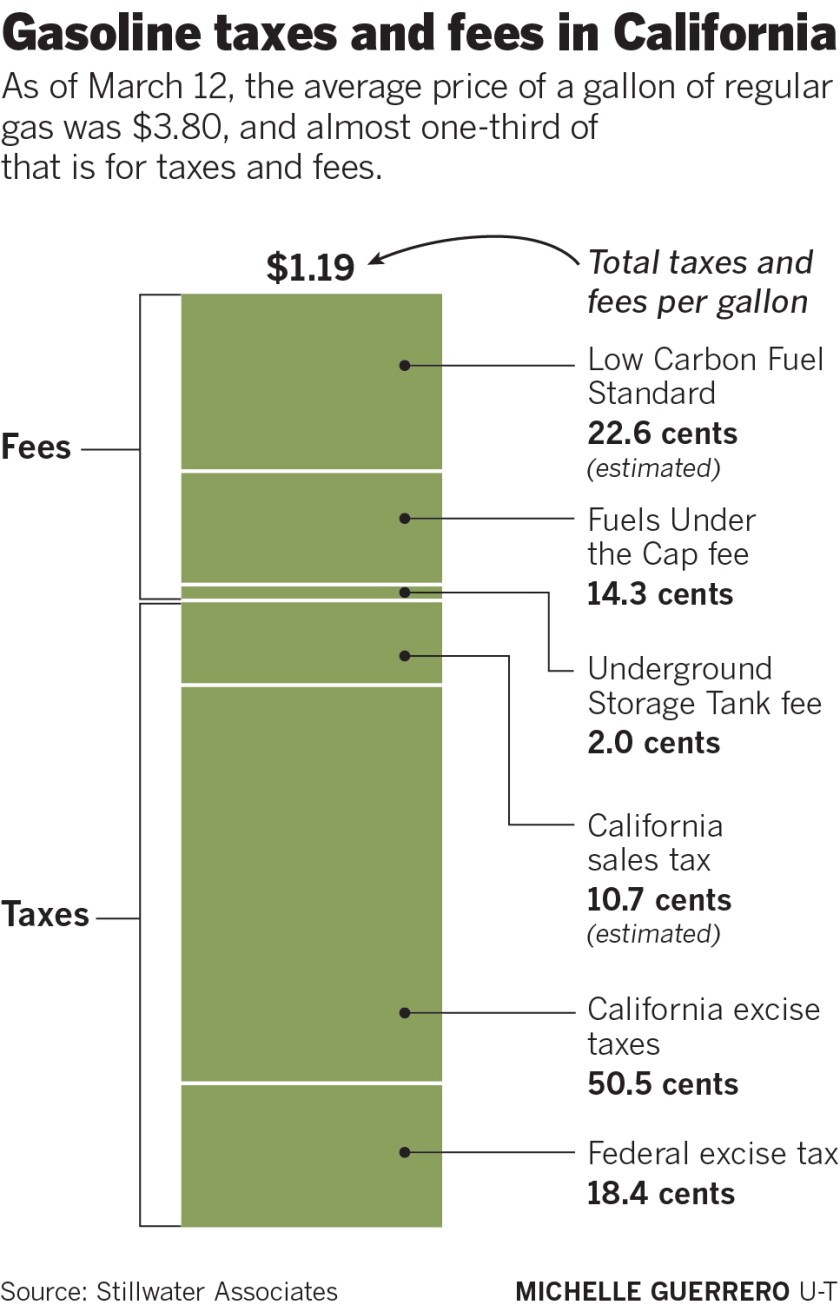

How Much Are You Paying In Taxes And Fees For Gasoline In California The San Diego Union Tribune

Payroll Tax Calculator For Employers Gusto

Taxfyle Online Taxes Filing Taxes Tax Preparation

What Is Hotel Occupancy Tax Texas Hotel Lodging Association

Texas Sales Tax Rate Changes January 2019

Texas Income Tax Calculator Smartasset

Texas Income Tax Calculator Smartasset

West Virginia Tax Rates Rankings Wv State Taxes Tax Foundation

Why Are Texas Property Taxes So High Home Tax Solutions

West Virginia Tax Rates Rankings Wv State Taxes Tax Foundation

2021 2022 Tax Information Euless Tx